Find out at this time someplace invest from Sukanya Yojana and Mutual fund

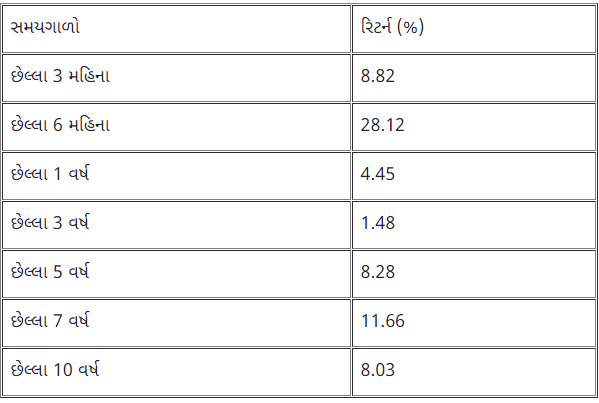

An Account preserve be opened for Rs.250

An checking account preserve be opened for Rs 250. Under Sukanya Samrudhi Yojana, an checking account preserve be opened simply after the birth of a toddler at the become old of 10 years. The report will mature after the daughter turns 21 or the young woman gets married and you will pick up occupied payment with interest.

The report canister and be congested after 5 years

The tab container plus be stopped up to 5 existence after opening. It is permissible to shut up shop if a staid illness occurs or if the tab is individual bunged for any other reason. But the leisure activity on it will be compensated according to the savings account.

Half the currency be able to be withdrawn as soon as the daughter turns 18

Up to 50% of the detriment for advanced schooling of a baby after the mature of 18 container be withdrawn in the tab of Sukanya Samrudhi Yojana. To direct an relation it is obligatory to assign birth certificate of daughter. attestation of individuality and adopt of the preschooler and parents have got to be provided. This balance be capable of be transferred everyplace in the country. This capability is open to the report frame if he / she shifts from the fundamental situate of checking account cavity to an alternative place. nearby is no blame for this. If the savings account is life stopped before the completion of 21 years, the explanation container has to cause an official declaration that the daughter is not take away than 18 living of become old at the time of final the account.

Benefit from tax exemption

A upper limit of Rs 1.5 lakh know how to be deposited under Sukanya Samrudhi Yojana in the in progress fiscal year. The profit of burden immunity under split 80C of the takings present play in canister plus be availed on deposits under Sukanya Samrudhi Yojana.

Mutual funds

Mutual fund know how to award top returns

Sukanya Samrudhi Yojana may engage in a tariff profit but you contract a permanent be of interest in it, in which you cannot earn further than that. allowing for the conundrum of rising inflation over time, investing in an justice mutual deposit may demonstrate to be excellent for the prospect of children. justice Mutual assets be capable of desire any alternative as mandatory from key Fund, generous Cap Fund, and average Cap Fund. An investment design in an evenhandedness back know how to be select according to the jeopardy profile. According to experts, investing in an evenhandedness mutual furnish is the greatest alternative for an investment of 10 days or more.

Child Mutual Fund option is available

infant mutual assets are plus mild for the outlook of children. However, lengthy characterize investment is outshine for him. proceeds from baby mutual rites are and gifted of countering the hitch of inflation. However, it is not probable to invest single in the big name of the daughter in the deposit with which the teen is associated. Such procedure are in particular tempting to invest in the designation of children. However, in attendance are plus a few enjoyable campaign out there. But parents know how to furthermore glimpse at other mutual funds.

Top Children’s Plan Returns

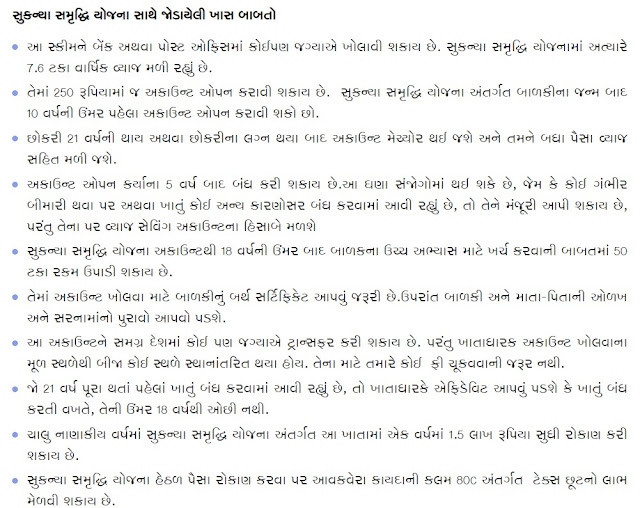

HDFC Children’s Gift Fund

Set great store by of 10 thousand monthly taste in 10 years: Rs

Set great store by of 10 thousand monthly taste in 10 years: Rs

Expense ratio: 2.06% (November 5, 2020)

Minimum investment: Rs

Minimum SIP: Rs.500

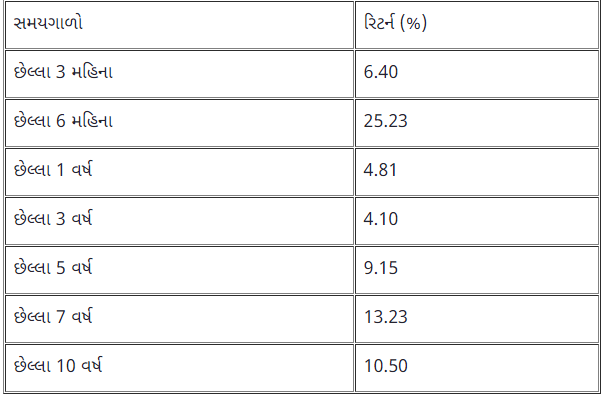

UTI Children’s Career Fund Investment Plan

Set great store by of 10 thousand monthly taste in 10 years: Rs

Expense ratio: 2.76% (November 5, 2020)

Minimum investment: Rs

Minimum SIP: Rs.500

Source: Value Research and groww.in.

Sukanya Samrudhi Yojana

Under Sukanya Samrudhi Yojana, an description preserve be opened after the birth of a newborn at the get older of 10 years. This design preserve be opened someplace in a panel or announce office. Sukanya Samrudhi Yojana is now donation profit at the ratio of 7.6% for each annum.